Currency

At our store, prices in your cart are automatically converted to the local currency based on your location. These prices are estimates using current exchange rates. The final charge will be made in US Dollars, with the exact amount shown. We are committed to transparency in all our transactions.

Taxes and fees

Paddle, our payment processor, is responsible for selling our software and collecting taxes in various regions worldwide. Tax rates differ depending on your location, and you can check Paddle’s website for a complete list of taxable regions. Rest assured that the final purchase amount, including tax, will always be displayed before you confirm your purchase.

Tax-exempt purchasing

Depending on the country some buyers may be exempt from paying tax.

After inserting your e-mail you may be able to insert also your VAT number and place a tax-exempt order.

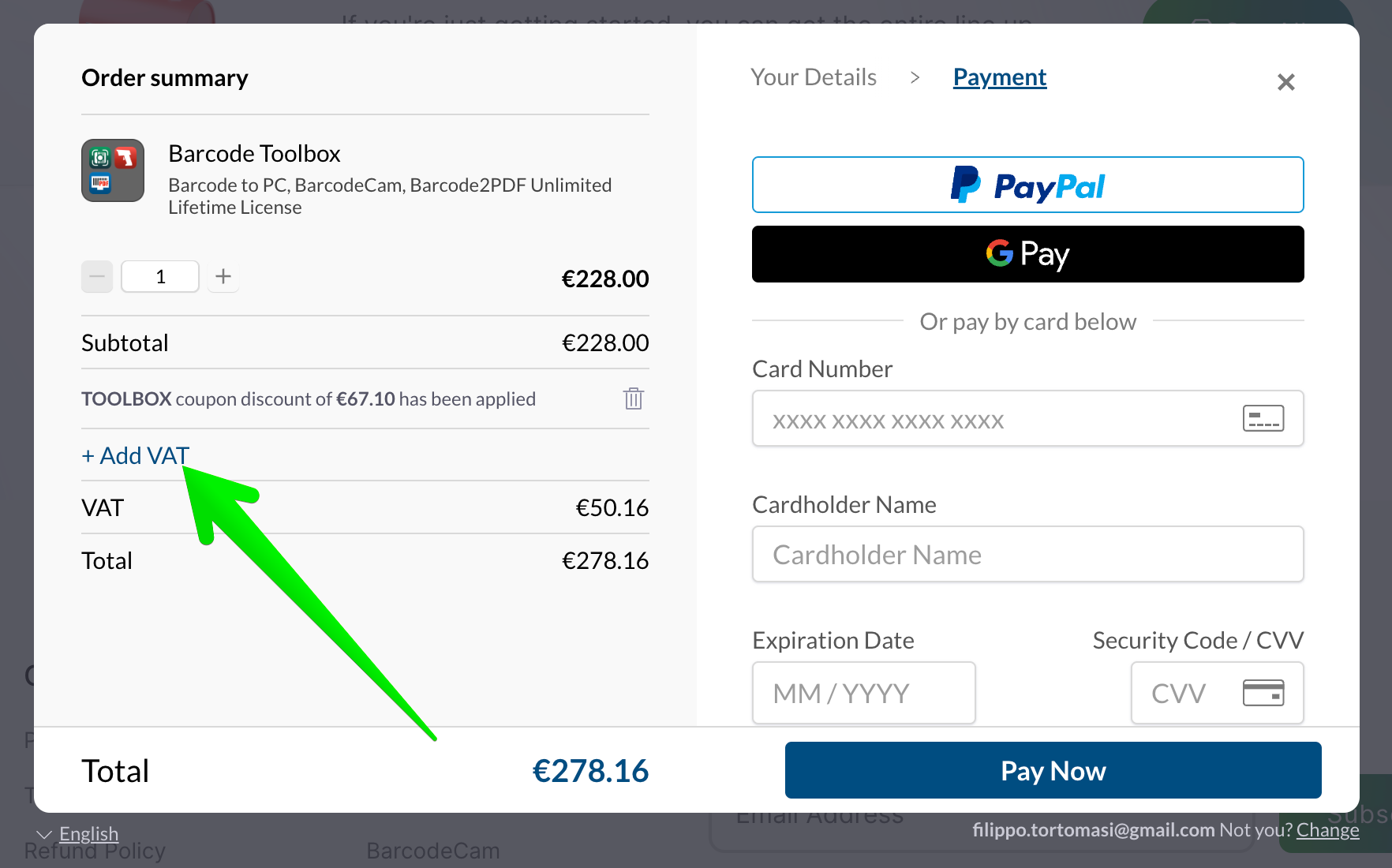

For European customers

If you’re making a tax-exempt purchase in the EU, enter your VAT ID during checkout to have tax removed from your charges. Look for “+ Add VAT” on the payment method selection screen. If you forget to enter your VAT ID, you can add it later by clicking on the link in your emailed receipt and entering the necessary details.

For US customers

If you’re a tax-exempt buyer in the US, please make a standard purchase through our store, which may include sales tax. At present, we are unable to exempt sales tax before purchase, but we can issue a tax refund after your order is complete. Please contact us directly with your tax-exempt details.

If your tax form requires details about the seller, please note that our payment processor Paddle is the “Merchant of Record”. You can find Paddle’s information on your receipt, as well as below:

Paddle.com Inc (US Entity)

54 West 40th Street

New York, New York 10018-2602

United States

Paddle.com Market Ltd (European Entity)

Judd House 18-29 Mora Street

London, EC1V 8BT

United Kingdom